Unless you’ve been living under a rock for the past years, you can’t fail to recognise the hugely important role and impact that social media had and is having in our lives. It has never been easier to contact a friend, reach someone and, more importantly, share information, which makes it essential for brands to have a social media presence.

A mobile wallet marketing campaign can also be boost by the benefits of what social media has to offer.

Take full advantage of it and use social media as an additional platform to create a buzz around your products, offers and increase awareness of your brand.

-

Create generic mobile coupons to be shared

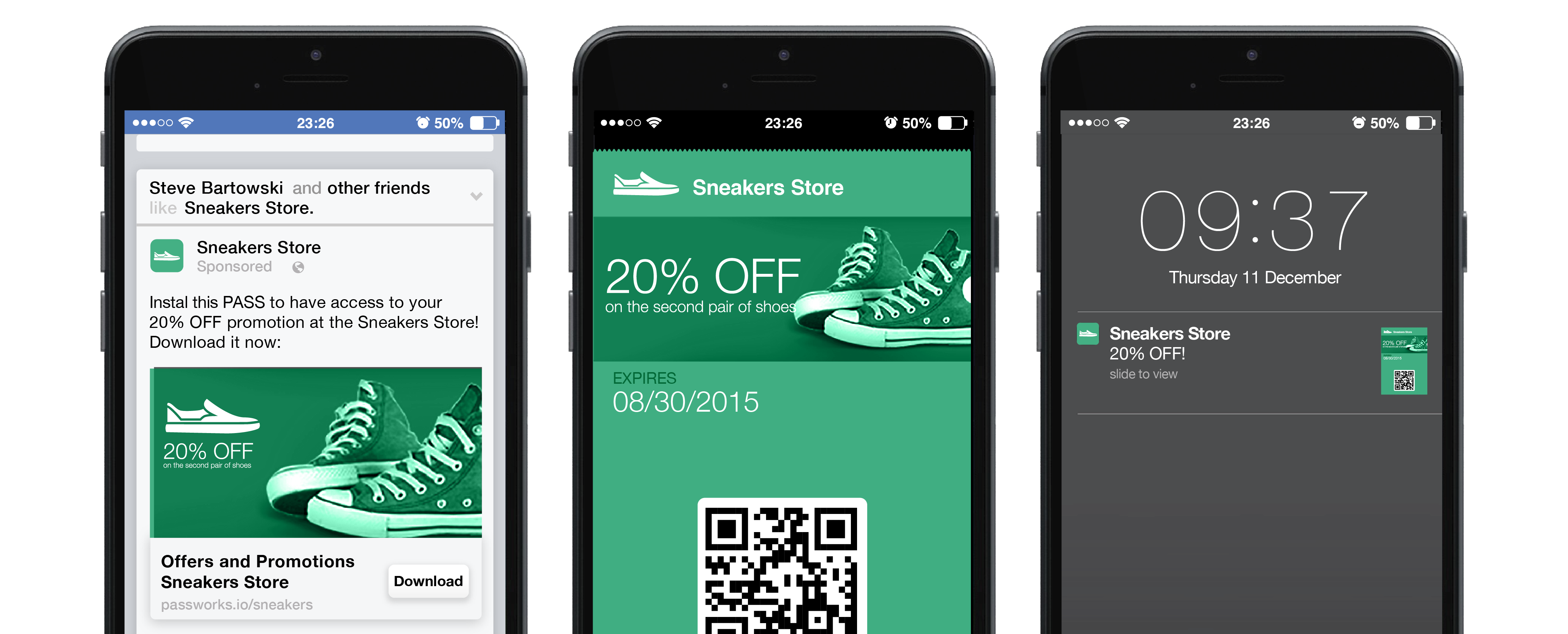

A mobile coupon can be personalized to a specific user or generic in order to be massive, meaning that it can be shared and used by everyone. By sharing a mobile coupon it will increases awareness of your brand on social media and maximises the exposure to your offers, attracting and acquiring new customers.

A Facebook referral promotion campaign is a great example of how to empower the effectiveness of a generic mobile coupon. The promotion works by enticing fans to gain rewards by referring friends to sign up, meaning they effectively do a lot of the hard work for you. The initial action of liking your brand’s page is a simple and task-free one for the users which increases your fan base. Then in order to access the coupon, a sign up is needed, giving you access to new customers’ email addresses to add to your mailing list.

-

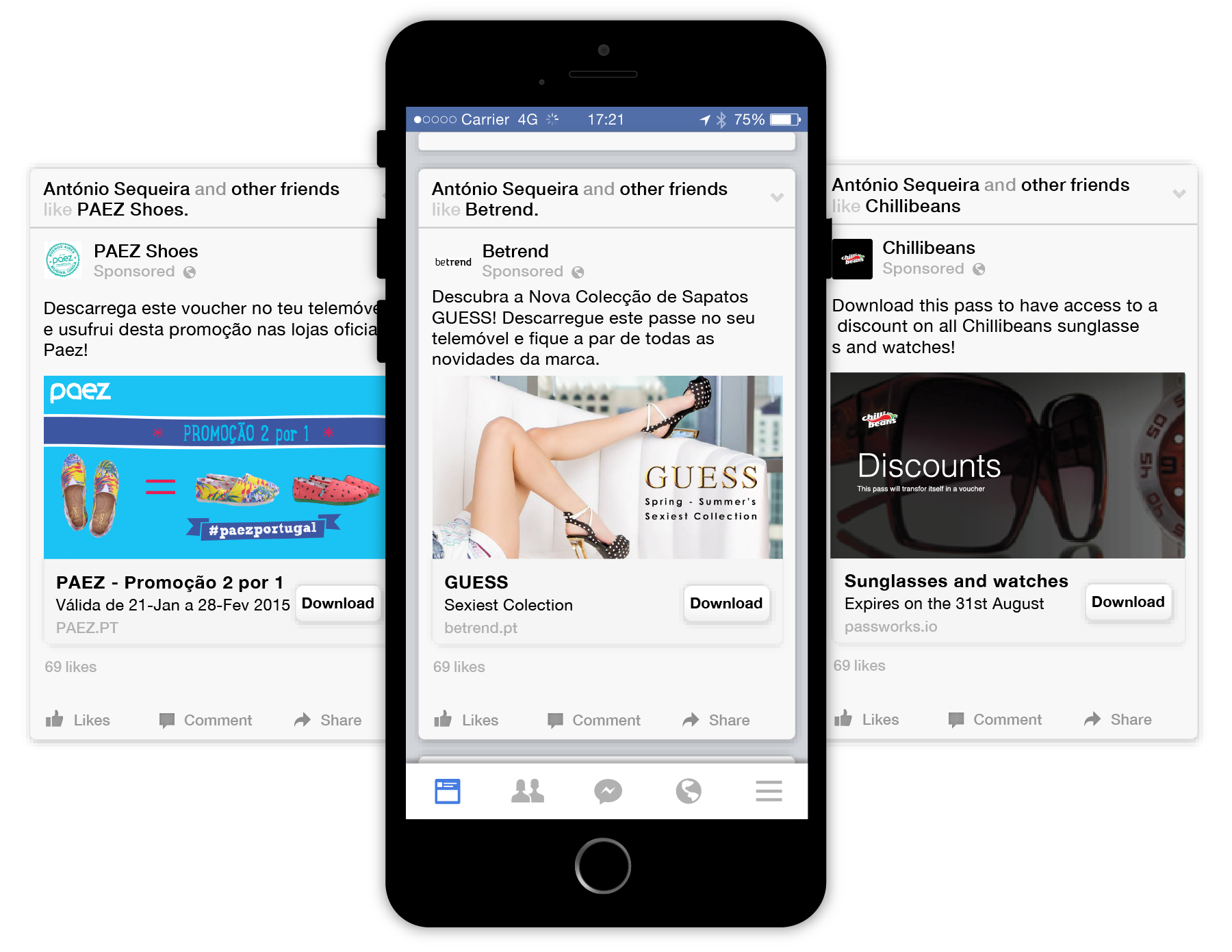

Link news feed posts to passes

Update your news feeds regularly with new information about the offers and to add the pass click the link to download. A pass will be added instantly into the smartphone’s digital wallet. That can include a generic offers pass that can be updated frequently with special promotions according to the brand strategy.

Your customers’ news feeds are also a springboard to attract new customers as their likes or retweets of offers will appear on their friend’s newsfeeds, making it more likely they will click on your page to see the offer if they know a friend has done it.

-

Make your customers aware of your technology

It’s key, that if you update your digital wallet technology content, to let your customers know the changes, and social media is a great place to communicate. As an example, if you’ve just incorporated your passes or loyalty card into Passbook, then updating your news feed to get that information over to your customer base is key.

Likewise, if you’ve introduced new technology in your stores, such as iBeacons, then sending information via social media allows to explain how it works encouraging your customers to try it.