Mobile tech dependency heightens this year with the prevalence of more mobile wallets and mobile payment systems. In a survey by Accenture, Millennials (23%) and those from higher-income households (38%) led the pack in contactless payments where they are said to them at least once a week. More than half of those from North America (52%) are already “extremely aware” of mobile payments, according to the research. However, mobile wallets will become even more popular this year due to various factors and changes in the mobile and tech industry.

Here are some of the biggest influencers of mobile wallets in 2016:

https://www.flickr.com/photos/38827603@N03/18302185568/

Mobile Wallet Marketing will become a must

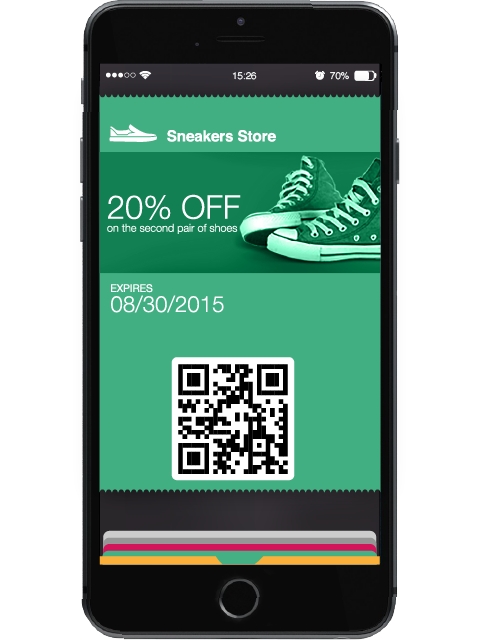

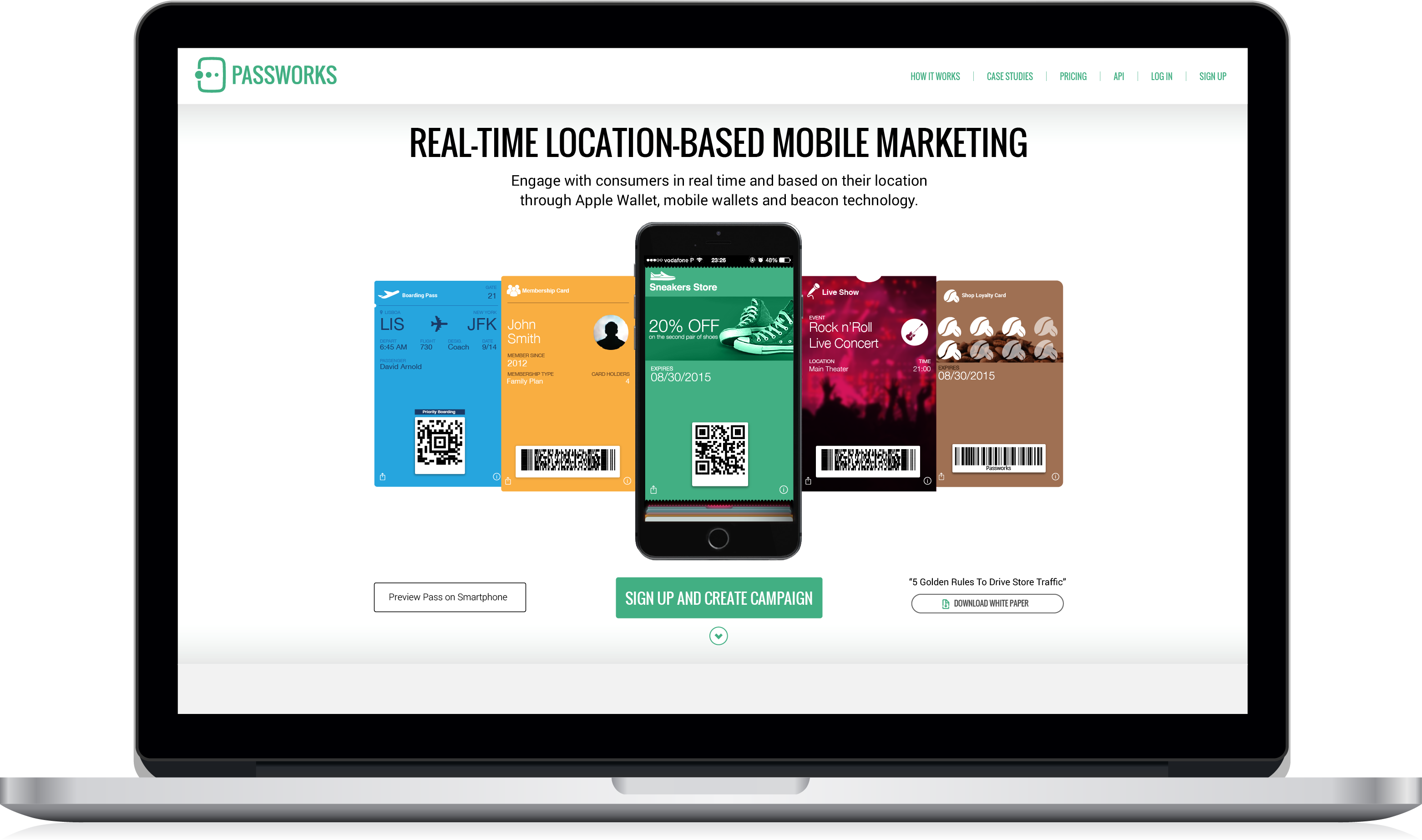

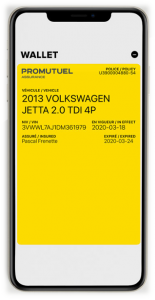

With Mobile Wallets, such as Apple Pay, Android Pay or Samsun Pay, customers now have more options than ever when it comes to paying via their smartphone. But mobile wallets have much more uses beyond enabling mobile payments, allowing users to add things such as coupons, store or loyalty cards, boarding passes, tickets or membership cards.

The non-payment side of mobile wallets is still nascent in terms of brand adoption, but as smartphone users are becoming more in sync with its functionalities brands should look to move their tickets or coupon and loyalty campaigns to more dynamic digital smartphone versions. Digital wallets form an important part of the current trend of new mobile technologies which are all focused on creating unique, innovative and real-time experiences for customers whilst paving the way for a more seamless transition between the physical and the digital worlds.

Bitcoin will become mainstream

Among the available crypto currencies worldwide, Bitcoin is the most popular and is becoming more accepted by consumers and businesses alike. In fact, some retailers have already started accepting this virtual coin as payment for transactions and we have seen a growing number of Bitcoin ATMs installed worldwide. In May 2015, there were already 400 machines installed globally and more are expected to be installed this year. Bitcoin is said to be taking on the popular virtual payment system PayPal, as it offers a more secure process to its users. Currently, Bitcoin firms are trying hard to make the currency mainstream.

“The benefit is going to be for people who want to use an online service, and don’t want to worry about managing and securing private keys and so forth. They can store as much as they want, there’s no fees, and it includes all the offline storage we provide as well as full insurance on all deposits,” said Bitcoin bank representative Jeremy Allaire.

Cheaper devices with NFC

The NFC (near field communication) chipset is now becoming a mainstream feature in almost all the handsets on the market, including the budget-friendly ones. However, many premium handsets in 2015 are still expensive, leaving many consumers waiting for the sales to give them a chance of owning such an expensive smartphones. Other NFC-enabled handsets are now also more affordable via various providers worldwide as newer devices are set to take over the market soon.

Iris scanning technology arrives

In 2016, a new biometric security in the form of iris scanning will dominate the next wave of mobile devices as it guarantees to be less costly and more secure than any known mobile sensors today. Since it will be more affordable than fingerprint scanning, we are hopeful that handsets with iris scanning will be cheaper, if not, it should at least have the same price tag.

We are certain that there are other factors that will affect the growing industry of mobile wallets this year, as new mobile technologies are set to revolutionize the next wave of smartphones.

Do you foresee the mobile wallet industry blossoming in 2016? We’d love to hear your thoughts so feel free to leave us a comment below.

Exclusively written for Passworks

By Tech-to-Day

Photo Credit: Vodafone Germany Corporate Communications via Compfight cc

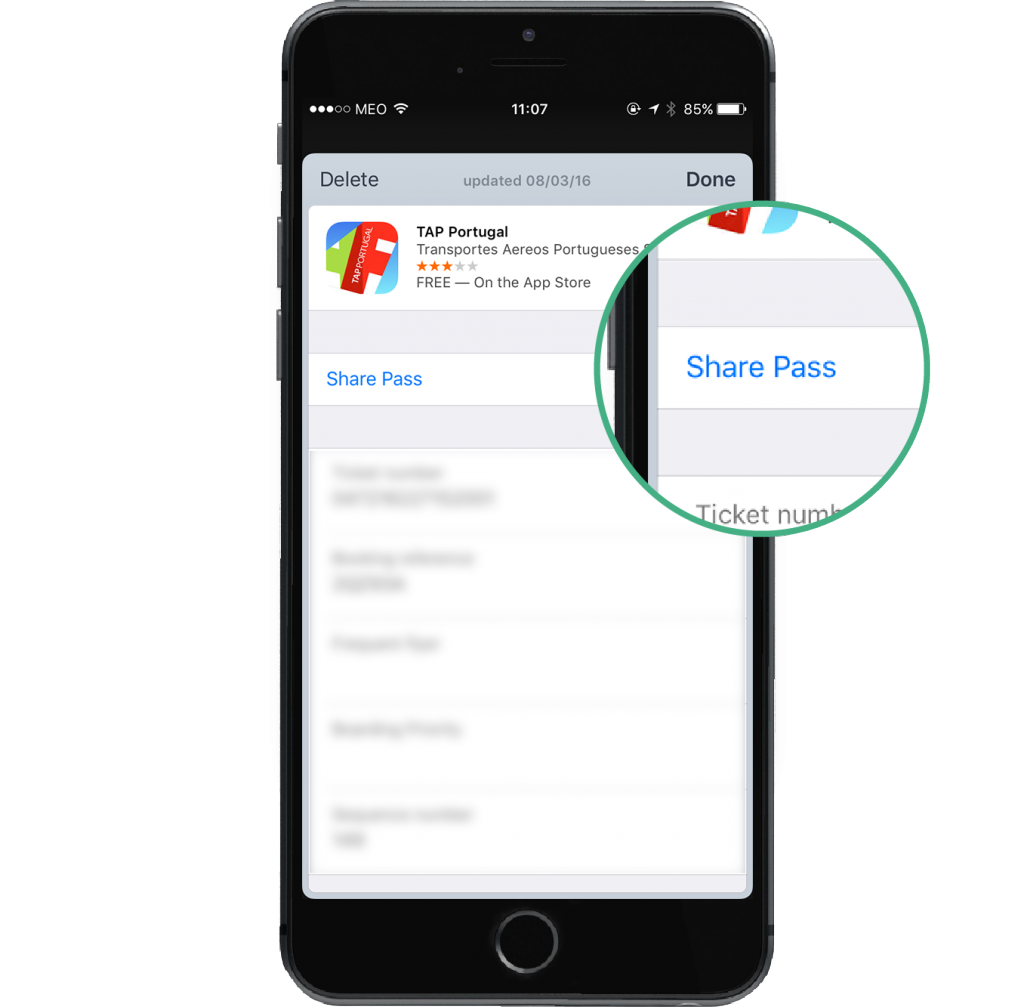

Apple Wallet has been an amazing channel for brands to engage with their customers and one of the features was allowing brands to promote their App at the back of their passes.

Apple Wallet has been an amazing channel for brands to engage with their customers and one of the features was allowing brands to promote their App at the back of their passes. Since the begging of Apple Wallet on the bottom left corner of the pass there was share icon. By tapping on that icon users were allowed to share their pass via message, mail or airdrop.

Since the begging of Apple Wallet on the bottom left corner of the pass there was share icon. By tapping on that icon users were allowed to share their pass via message, mail or airdrop.