The unique features of iBeacon truly offer the ability to revolutionise retailers’ in-store experience, by allowing a better understand of customers’ path, real-time interaction with their customers, which represents a huge potential to engage in new products and offers to increase sales. But automatically there are two questions that arise.

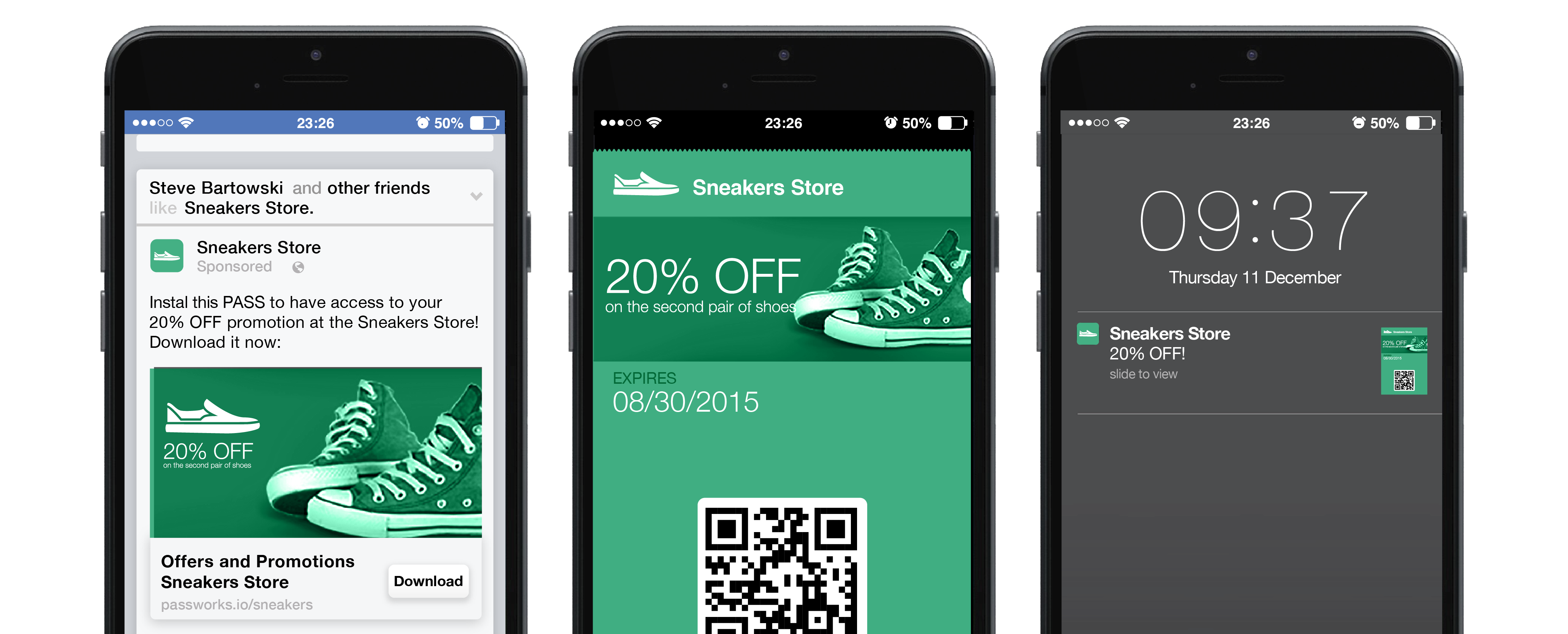

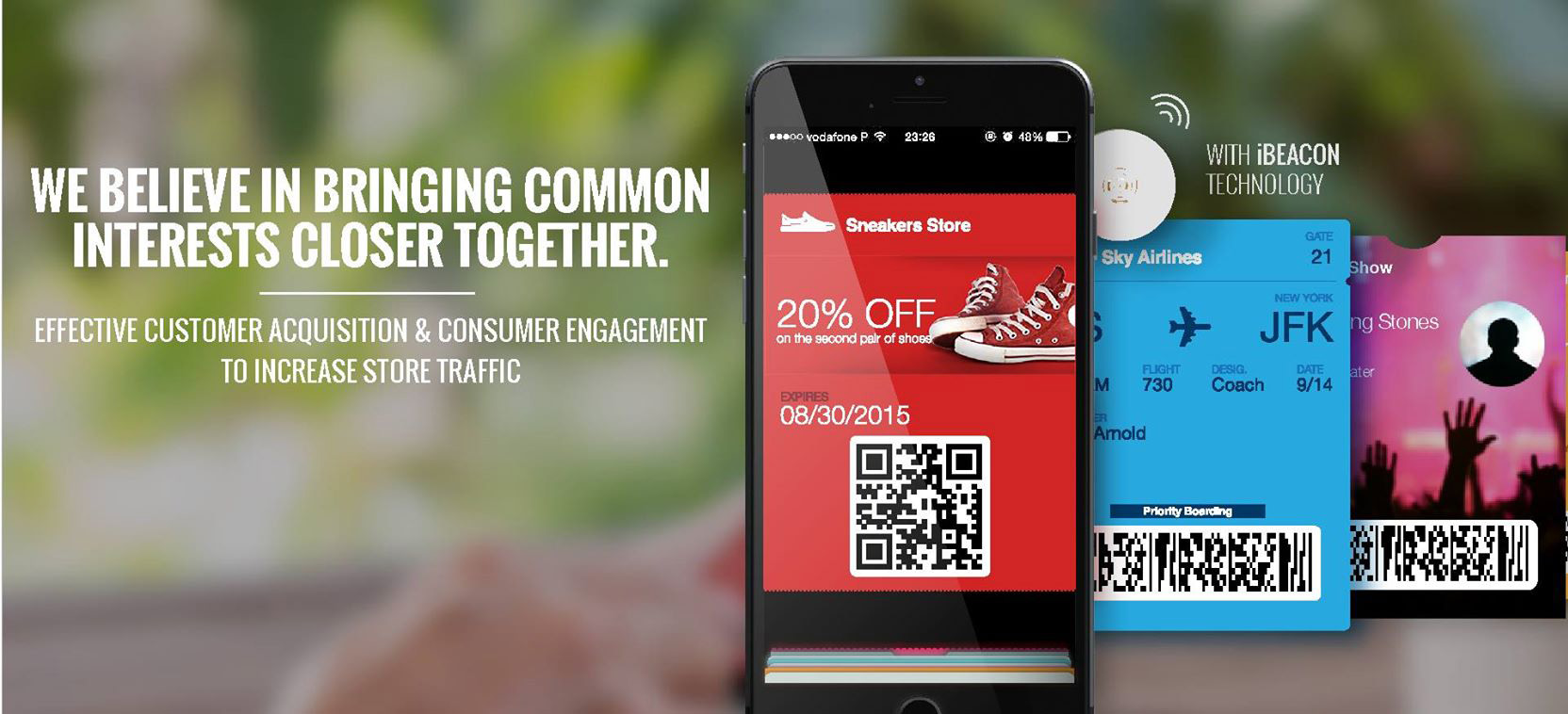

The first question is what is an iBeacon and how it works? Beacons are Bluetooth Low Energy (BLE) devices, that work as small indoor positioning systems, to send information to nearby smart devices. In the case of a smartphone that information is delivered via the brand’s App or through Passbook, and then displayed as a push-notification on a pre-subscribed user’s screen.

This enables retailers to send-up-to date, contextualized and relevant information to a customer depending on their exact location in the store and based on their behaviour.

For example, imagine you’re in a department store that sells a vast range of products, each time you walk past each section and are near that particular beacon you’ll might get a different message on your phone, be it promoting a new line of clothes or a discount on French wine etc.

The second question that needs to be asked by the retailers is ‘What can Beacons offer to my customers?’ The answer to this question is very simple; Facilitate and improve their in-store shopping experience. iBeacons offer a cost-effective way to efficiently engage with customers on a platform they are familiar with, their smartphone.

These days, the smartphone goes everywhere with the customer and it’s already integrated into their shopping habits, particularly as many major retail brands offer an App to browse and buy all their products. According to a research carried out by Swirl, 85% of those who own a mobile shopping App use it whilst shopping in a store. Furthermore, 65% of them said they consult their smartphone whilst in a store to find out about products and offers. This means, that through the smartphone, retailers already have a ready-made platform to attract their customers’ attention, and a push notification from an iBeacon is one of the best ways to do that.

The benefits of this technology for both retailer and customer are endless, and the possibility to create more interaction between the two is one that can even bring more trust and build the relationship, whilst allowing the retailer to reap the rewards of offering them better service.

Finding the right equilibrium to make the best use of iBeacons is crucial. In the case of normal push-notifications, the balance of sending the right amount to users is a difficult thing for brands to gauge. However, with real-time location-based push-notifications, retailers can send information to customers at a time when they actually want to find out more about product offers, and best of all, since they are already in-store means they are in the perfect place to act on those messages and buy products.

iBeacon can also work side-by-side with a store’s existing technology, to give retailers a way to better understand their customer’s behaviours, tastes and needs, whilst offering them a more personal shopping experience.

For example, when iBeacons’ push-notifications are used in conjunction with the store’s App and existing CRM platforms, retailers have the ability to tailor the messages they send out to specific customer group.

How it works is that when the customer’s smartphone receives the information from the iBeacon, prompting the App to send a push notifications, the store’s system can also be notified who it is that has entered the store. Automatically, the staff working at that time will, have access to important information, such as purchase history or what tastes and prefer products that customer has. Likewise the message sent out by the iBeacon, could be totally personalized and can be sent only to a particular group of shoppers and thereby maximise the exposure of certain products to the right target group.

Summarising, iBeacons represent a neat and effective way for retailers to better understand and get closer to their customers by enabling them to easier access contextualized and relevant offers, and thereby increasing sales.