As we prepare to embrace 2016, is always good to look back

and see what happened in 2015, specially within the mobile wallets industry.

Back in January, Marketing Land defined some major mobile trends considering mobile-as-a-channel:

“Mobile will also play an increasingly important role in the evolution and user behaviour of social networks both new and existing”.

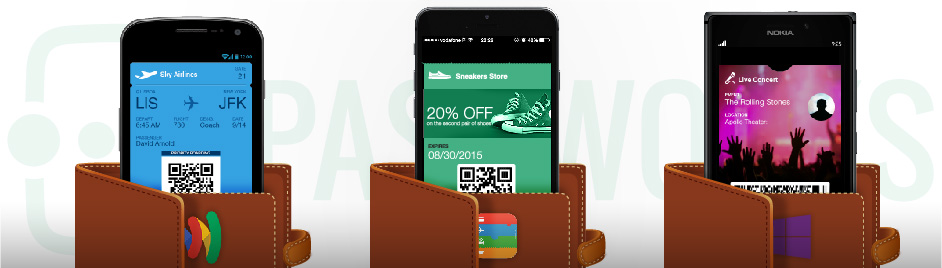

And within those trends, we saw Mobile Wallets becoming a reality. One of the most relevant facts of mobile wallets, was that on top of the high usage for payments the growth of mobile wallet marketing, specially in the retail, travel and accommodation industries, alongside with the integration of location-based marketing tools such as beacons technology.

Business 2 Community reported in July that “44% of consumers would like brands to deliver deals and coupons to their mobile devices“ building an even more momentum for the mobile wallet marketing. Also in July, and after the successful launch in the US, we saw the Apple Pay debuted in the UK, making its presence at 250,000 locations all over the country and supported by major apps like Five Guys, Zara, YPlan and MyCheck in the restaurant industry.

In the second half of the year, on September 10th, Google “fought back” and released Android Pay in the US, already accepting American Express, Discover, MasterCard and Visa, their second mobile wallet attempt. Despite not being yet a native App brought several relevant functionalities and also allows storing gift cards, loyalty card and special offers. According to PYMNTS, “Android Pay is compatible with roughly 70% of the Android phones currently in the U.S. “ and, with Android occupying 51.6% of the US smartphone market, you never know how will this mobile wallet battle turn out to be.

It wasn’t long before Apple came back to the spotlight. A few weeks later, on October 1st, Apple launched its new operating system iOS 9. Among new devices such iPhone 6S and a new Surface Pro competitor (iPad Pro), this new update brought a makeover from Passbook App to Apple Wallet, a new loyalty program and EAN 128 codes for digital passes. Dunkin´ Donuts, Walgreens Balance Rewards, MyPanera, among others brands are already supporting these new iOS 9 features.

Right after the launch of Apple’s new iOS, Android Pay pushed a new loyalty program which allows its users to buy cheaper Cokes after the purchase of full price Cokes at vending machines. According to PYMNTS, “the move has been widely applauded by mobile watchers, who note that Google is going the extra mile to help users build habits around phone use but giving them an easy and literally rewarding way to build the habit.”.

Apple continued expanding Apple Pay with the launch in Canada and Australia in November. Jennifer Bailey, Apple’s vice-president for Apple Pay mention to CBC “the company is starting with American Express in Canada and Australia because it’s both the card issuer and the payment-network operator so co-ordination is easier“, meaning that Visa and Mastercard users still have to wait for compatibility. However, back to 2014 and according to the Nilson Report, Amex users accounted only for just 5% of Canadian spending and 17% in Australia, so the outcome is still being figured out.

For Apple next countries will be Spain, Hong Kong and Singapore during 2016, while for Google the next target is Australia.

With all these launches and features upgrades, Passworks have been evolving as well. Using Passworks platform it is now possible to create passes with EAN 128 code with an alternative code for iOS 8 users and also to deliver mobile passes through CSV file, Email and SMS, which makes it possible for brands with different types of CRM to create mobile content. Another obstacle that usually stands in the way of brands’ campaigns is the POS implementation and technology compatibility issue, due to the fact that most of scanners only read a certain type of code, which made it impossible to create marketing campaigns that couldn’t be redeem. Henceforth, Passworks team developed an App called Passworks Scanner, available for both Android and iOS that enables Passworks’ users to use this app to redeem the passes and monitoring the campaign. Also, Passworks developed its own wallet app, which enables Android users to experience the same Apple’s Wallet usability. Finally (wow, it was a full year!), Passworks is having a work-in-progress makeover, which means that during these next few months, there is going to be a lot of improvements, as seen by the new already implemented design.

With the emergence of this new mobile wallet ecosystem, leaded by Apple Pay, Google Wallet, Android Pay, Samsung Pay and PayPal Wallet, this means a great opportunity for brands to invest because not only it is increasing exponentially the visibility among users but because it is starting to change other markets, such as banking, and become mainstream.

According to Business Insider, “Apple announced a number of forthcoming changes to Apple Pay, including synchronization with rewards cards”, which means that marketing is even more embedded on these interactions and that these digital channels provide a relevant experience for consumers and opportunity for brands.

There is a great concentration on the mobile business, whether in payments, marketing or advertising. 2015 is not yet over and the numbers showed by EConsultancy are already showing a “10% increase in paid search advertising spend compared with last year, with all growth coming from ads on mobile devices”. Nevertheless, the outcome is always dependent from brands’ marketing strategies, context and how well do they really know their consumers’ behaviors and engage with them. More and more there is no way to escape the premise that “mobile can no longer be viewed as a separate channel”.

The bottom line is that brands must put the consumer at the center of their digital strategy because location-based mobile marketing drives multi-channel conversions, offline actions and consumer engagement, as can see on the Warehouse’s case study: “Since moving our coupons to wallet, we’ve seen significantly increased top-of-mind visibility among consumers, and we expect to achieve seven-figure sales results from our investment in 2015”.